Services

Investment and Hedging Solutions across All Major Asset Classes

Services

Explore What We Offer

0

+

Years Of Experience

0

+

Happy Clients

0

+

Portfolios Managed

0

+

Team Members

Principal Investment Strategies

Designed to Achieve Superior Risk-adjusted Returns

Equity Investment

The Fund’s equity investment strategy represents positions in Equity listed derivatives designed to provide exposure to mainly US financial market.

Fixed Income & Commodity

With the resurgence of volatility in commodities in 2022, commodity based trade signals are getting generated more consistently.

FX and IR Hedging

In addition to providing structuring and execution advise around hedging Foreign Exchange and Interest Rate exposures, SIVA provides institutional clients a netting algorithm, which seeks to achieve pre-defined risk mitigation objectives (VaR limits) at minimal cost (lowest hedging cost).

Performance

Performance over time provides an indication of the Risks

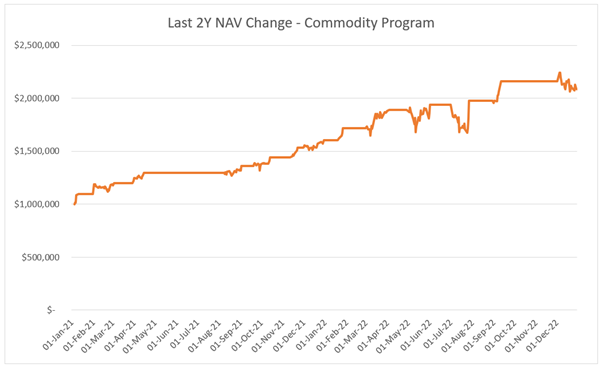

The chart below (as of Dec 31, 2022) shows the last 2Y performance of our fully automated systematic commodity program. Minimum investment size is $1MM and the program is open to institutional investors only.

The variability of performance over time provides an indication of the risks involved in investing.

Principal Risks

Investments in the Fund Market involves Substantial Risks

Loss of money is a risk of investing in the Fund. As with all investment funds, an investor is subject to the risk that his or her investment could lose money.

Investments in the Fund involve substantial risks which prospective investors should consider carefully before investing. Additionally, past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future.

Portfolio Turnover

Fund’s Portfolio Turnover rate was 45% of the average value of its Portfolio

The Fund generally pays transaction costs, such as brokerage commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example above, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 45% of the average value of its portfolio.